Agro Yield

Agro Yield

10 Jun 2024

09 Jun 2024

Introduction: What Does Your Money Grow?

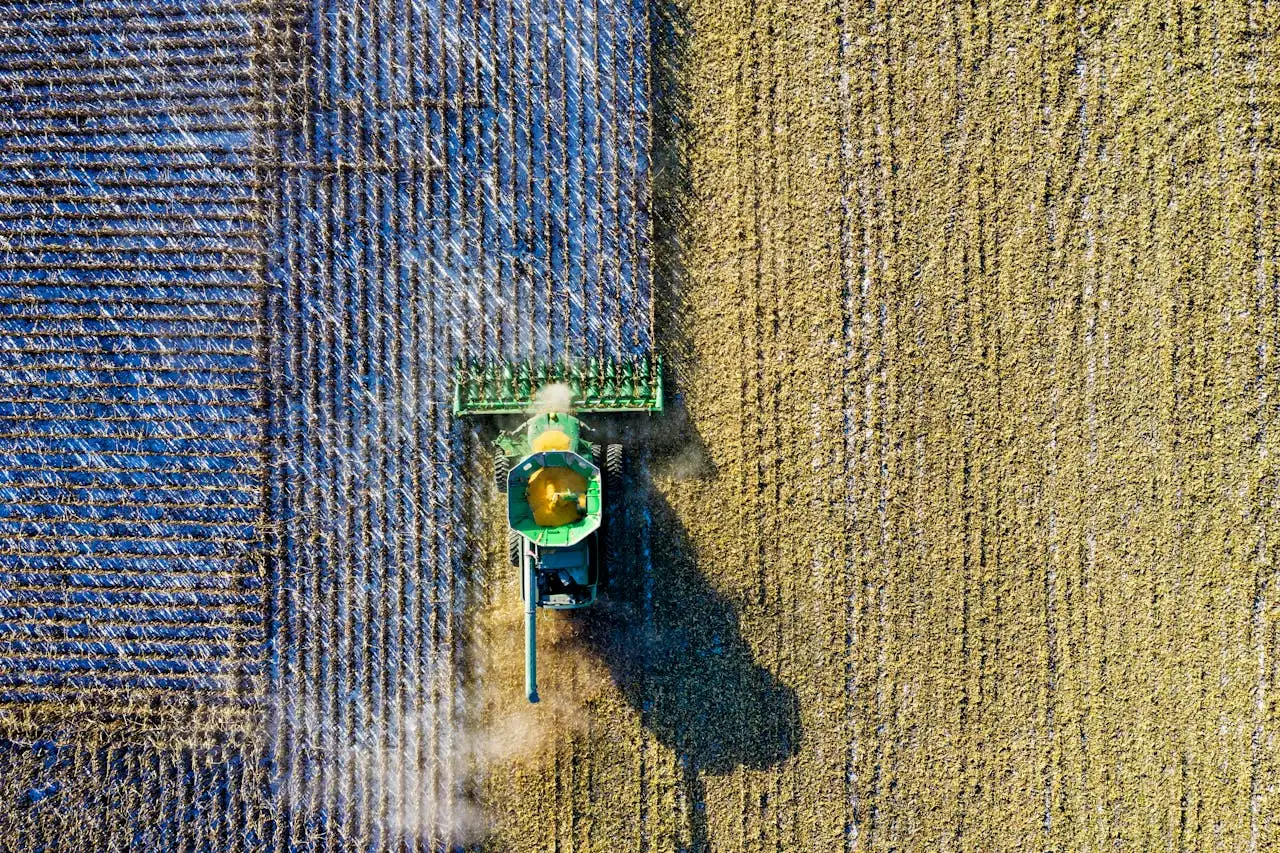

Imagine putting your money somewhere that grows just like a seed. Slowly, steadily, and strongly. That’s exactly what happens when you invest in U.S. farmland through a company like Agro Yield Partners. While many people chase stocks or digital coins that go up and down fast, farmland offers something different—real growth backed by real crops on real soil.

In this blog, we’ll walk you through the full journey of a U.S. farmland investment project—from the day it starts to the moment you get paid. You'll see how your money turns into food, profits, and long-term value. No farming skills required—just a belief in nature, patience, and good management.

A farmland investment project is a real-world agricultural business that allows outside investors (like you) to join in the profits.

Each project has:

A real farm or farmland site in the U.S.

A crop or livestock focus (corn, wheat, almonds, cattle, etc.)

A farm team managing the day-to-day work

A set period of time (like 12 or 36 months)

Expected profits based on yields and prices

A payout structure (monthly, quarterly, or at the end)

You’re not just buying land—you’re joining a farm’s business model.

With Agro Yield Partners, the full farm lifecycle is handled for you. Your role is to invest, track the project, and receive returns.

Before any project opens for investment, Agro Yield Partners does deep research:

Land Quality: Is the soil fertile? Does it support healthy crops?

Climate: Is the weather reliable for farming this crop?

Water Supply: Does the farm have proper irrigation or rainfall?

Market Demand: Can the crop be sold easily, at good prices?

Farm Team: Does the team have experience and local knowledge?

Technology Use: Are smart tools used to improve efficiency?

Let’s say they choose a blueberry farm in Oregon. The area is known for good weather and soil. Demand is high in supermarkets and export markets. The farm uses drip irrigation and drone monitoring. Perfect.

Next, the team creates a clear business plan:

Project cost: land lease, labor, water, tools, seeds, fertilizers

Timeline: planting, growing, harvesting, selling

Risk planning: weather, pests, crop failure

Return plan: how and when profits will be shared

Let’s say the project has a $500,000 budget. Agro Yield opens it for investment, offering units starting at $5,000 per investor. Each investor gets a share of the total returns based on how much they put in.

Once the plan is live, investors can log into the Agro Yield dashboard and:

Read the full project details

Review profit expectations

Check risk disclosures

See past performance of similar farms

Ask questions or talk to support

If you're happy, you choose how many units you want to invest. For example:

Olivia invests $5,000

James invests $10,000

Sophia invests $20,000

The project closes once it’s fully funded.

Now the farm gets to work using the investment money.

What happens next:

Soil Prep: Machines plow and fertilize the soil

Planting: Seeds or crops are planted, sometimes by hand, often by GPS-guided machines

Monitoring: Drones fly over crops to spot weak areas

Irrigation: Smart watering systems save water and support healthy growth

At this stage, you start receiving updates. Your dashboard shows:

Images of planting

Monthly reports

Growth tracking

Weather data

Expense summaries

You get to “see” the farm without ever visiting it.

This is when things can get tricky—and when Agro Yield’s experience really matters.

They use tools to:

Spot crop disease early using satellite images

Adjust irrigation if there’s too little or too much rain

Add fertilizers based on real-time soil readings

Keep pests away without overusing chemicals

They also track labor costs, crop growth stages, and local prices. If needed, they adjust strategies quickly to protect your returns.

Meanwhile, you still get updates every month. You know:

How much of the crop has matured

How the team is responding to challenges

How much has been spent

Whether returns are on track

Now comes the big moment—the harvest.

Let’s say this blueberry farm produces:

80 tons of blueberries

Market price: $2.50 per pound

Gross income: $400,000

From this, the farm deducts:

$220,000 (operating costs)

$10,000 (insurance, taxes)

$20,000 (maintenance + reserves)

Net profit = $150,000

This is where investor payouts begin.

Depending on the project, you might receive:

Monthly or quarterly dividends from crop sales

End-of-term lump sum (if the profit is realized after selling land or final harvest)

Agro Yield Partners transfers your returns directly into your investor wallet or connected bank account.

Example: Sophia invested $20,000 in the blueberry farm.

Her share of the project: 4%

Total profit: $150,000

Sophia’s return: 4% × $150,000 = $6,000 profit

Capital returned at maturity = $20,000

Total payout = $26,000

All transactions are visible in your dashboard. You can withdraw, reinvest, or hold it.

At the end of the project or each tax year, you’ll receive:

Yearly income reports

Statements for tax filing

Breakdown of capital gains and dividends

Agro Yield Partners works with legal and tax experts to keep things compliant. You just hand your forms to your accountant.

Once a project ends:

You can reinvest into a new one

Choose a different crop or location

Diversify across 2–3 farms

Take your returns and walk away—it’s up to you

Some investors choose to build a farm investment portfolio across:

Almonds in California

Corn in Iowa

Greenhouse tomatoes in Texas

Cattle grazing in Colorado

The idea is simple: spread your risk, increase your returns.

This is what we mean by “From Seed to Success”.

✅ Simple — You don’t need to know how to farm

✅ Secure — You’re investing in real, managed assets

✅ Transparent — You see everything happening

✅ Flexible — Choose plans that match your goals

✅ Sustainable — Food demand keeps rising

✅ Long-term gains — Build real wealth over years

This is not about getting rich overnight. It’s about steady, reliable growth—something smart investors appreciate.

Q: What happens if the crop fails?

A: Agro Yield uses crop insurance, backup funding, and experienced teams to reduce losses. Not every project hits 100%, but many reach or exceed expectations.

Q: Can I lose my capital?

A: It’s possible, but rare. The company selects only low-risk, fully vetted farms. And projects are diversified to limit damage from any one event.

Q: Do I own land directly?

A: Usually no—you own a share in the project, which includes rights to profits and capital, but not personal land ownership.

Q: Can I withdraw anytime?

A: No. You must wait until the project or plan ends. This helps ensure proper farm management and stable investor returns.

Every project is handpicked

We work only with U.S. farmland

Investor updates are simple and real-time

Each farm is backed by modern tools and expert teams

You’re treated as a partner, not just a funder

Farmland isn’t just dirt. It’s where wealth grows slowly and surely. If you’re ready to build something that lasts, it’s time to start your journey—from seed to success.

Your Money

Your Money